Sure Bernie Madoff was a crook. Sure he took money from investors large and small, wiping out people's college savings and life savings and so much more. He stole a total of $20 billion in invested funds before the bottom fell out.

And that's nothing.

That's nothing compared to what is really the world's largest ponzi scheme. You almost certainly are being bilked by that scheme. You're like a Bernie Madoff investor, but in a scheme that's at least 1000 times worse. Probably more like 3000 times.

And I'm in that boat with you.

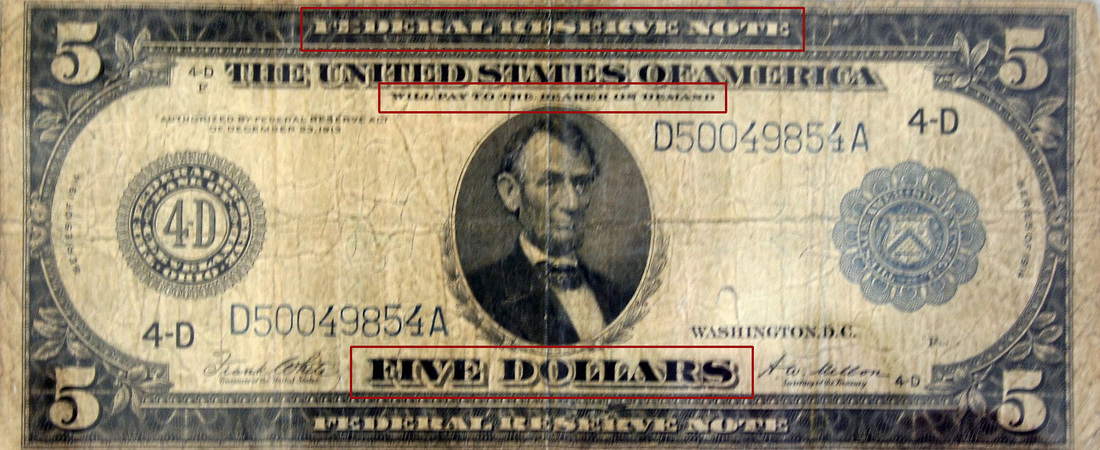

This Ponzi scheme dates back to 1913 when a group first started accepting investments in stock certificates that, at the time, you could redeem for the amount you originally paid (but without any sort of "return on investment").

People paid in gold, silver, and even things like real estates through the process of mortgages to get these certificates. And for more than 100 years, this group has continued taking real assets in exchange for something that is nothing more than paper, backed by nothing but our faith in it. Like Madoff, this group has only been able to keep the scheme going with a continual flow of new investments. And their investor pool is much, much larger. In one way or another, it probably includes billions of people.

I am, of course, talking about the Federal Reserve banking system.

In order to keep the Ponzi scheme going, this banking system has printed more and more money through the years, to the point that one dollar in 1913 is worth about 2 to 3 cents today. They have, by printing dollars, stolen from the pocket of every investor more than 97% of the original investment. They stole more when people were losing their houses but the system decided to bail out just the banks.

Where did the houses go? Also to the banks.

The only way Madoff could keep things going for so long is because he was indeed able to pay back early investors with the income from later investors. And in a similar way, the Federal Reserve system once paid people back their investments if they wanted. This is why "Federal Reserve Notes" (what we call dollars) once said "Will Pay to the Bearer on Demand ... Five Dollars," which meant you could still go to the bank and get real assets for your note. It was an IOU. After a while, they dropped that language and made Federal Reserve Notes our legal tender, backed by nothing.

And still we keep investing, because it's the only thing we know. (But are alternates like Bitcoin a first look at another way?)

Eat your heart out Bernie. You were small potatoes.

RSS Feed

RSS Feed